Fraudulent Bank Advertisements on Instagram Expose Victims to Financial Scams

Fraudulent advertisements on Instagram, including deepfake videos, are impersonating reputable financial institutions such as Bank of Montreal (BMO) and EQ Bank (Equitable Bank) to deceive consumers. These scams utilize advanced techniques to target unsuspecting individuals.

Scammers employ various strategies, including Artificial Intelligence (AI) to generate realistic deepfake videos with the aim of collecting sensitive personal information. Additionally, they may direct users to typosquatted domains that closely resemble the authentic websites of the impersonated banks, thereby adding a layer of deception.

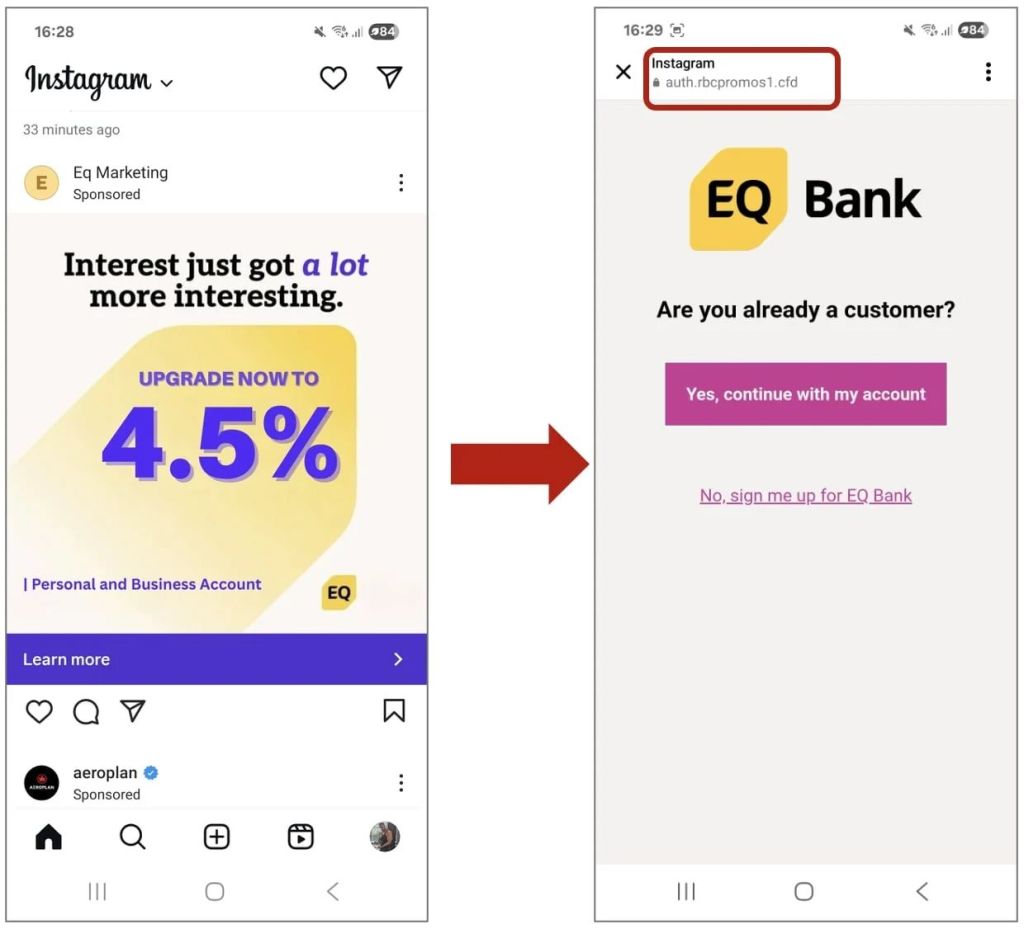

An example showcases an advertisement labeled as “Eq Marketing,” which closely imitates the branding and color scheme of EQ Bank, while promising an enticing interest rate of “4.5%.”

In this scenario, clicking the “Yes, continue with my account” button leads the user to a fraudulent “EQ Bank” login interface, requesting banking credentials. This action likely results in the scammers accessing and draining the victim’s bank account.

Another deceptive advertisement pretends to be from BMO’s Chief Investment Strategist, Brian Belski, misleading individuals into believing they are receiving credible financial guidance. This tactic often includes invitations to join a “private WhatsApp investment group.”

The impersonation of bank officials and authoritative figures is becoming increasingly prevalent, often delivered in a convincing manner. Scammers typically create a sense of urgency, pressuring individuals into making immediate financial transactions that may inadvertently lead to transferring funds to fraudulent accounts.

Such scamming tactics are not confined to Instagram; similar invitations to WhatsApp investment groups are encountered on various social media platforms like X multiple times each week.

It is imperative that cybersecurity risks are recognized and addressed proactively to ensure the safety of online interactions and transactions across social media platforms.